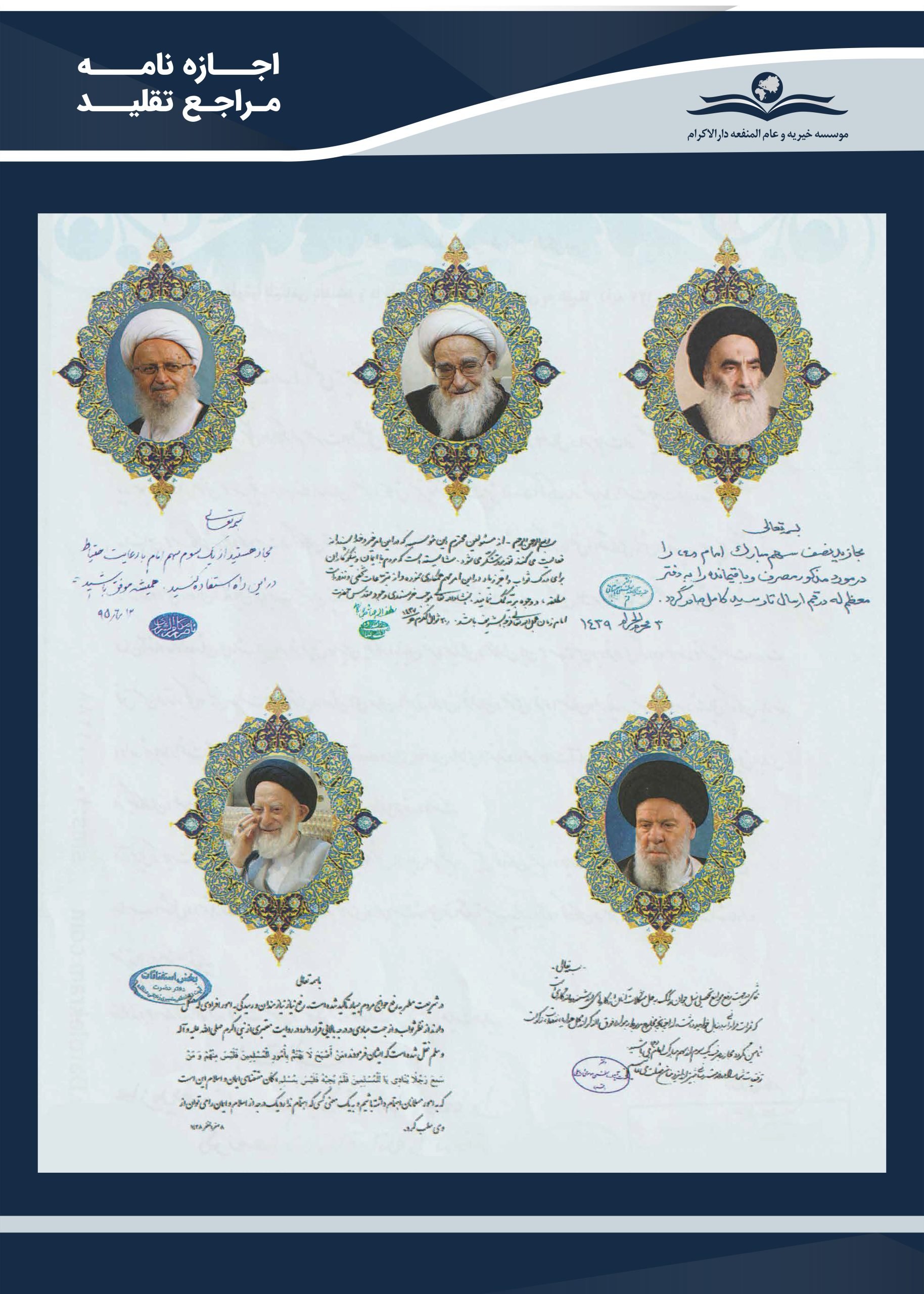

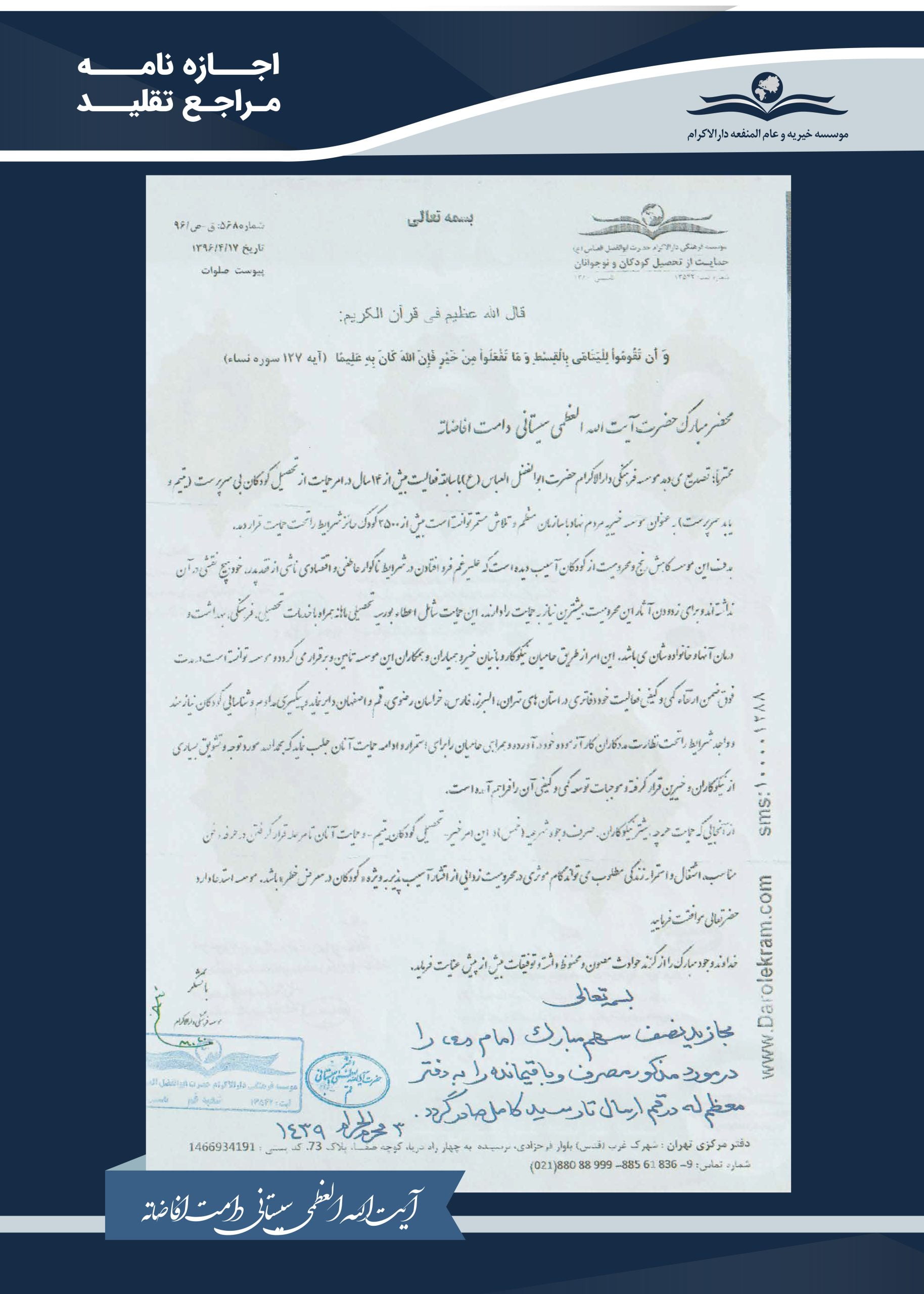

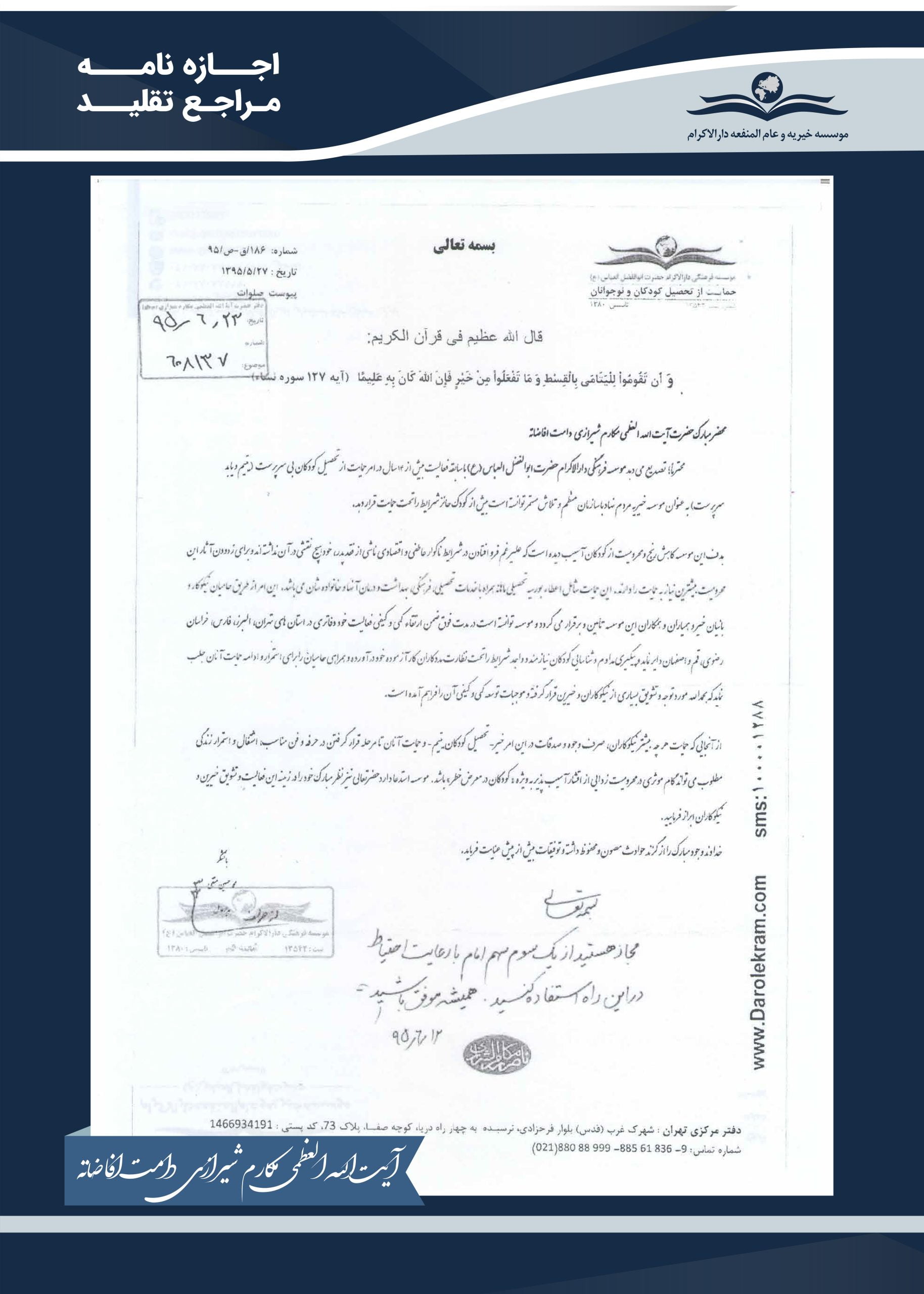

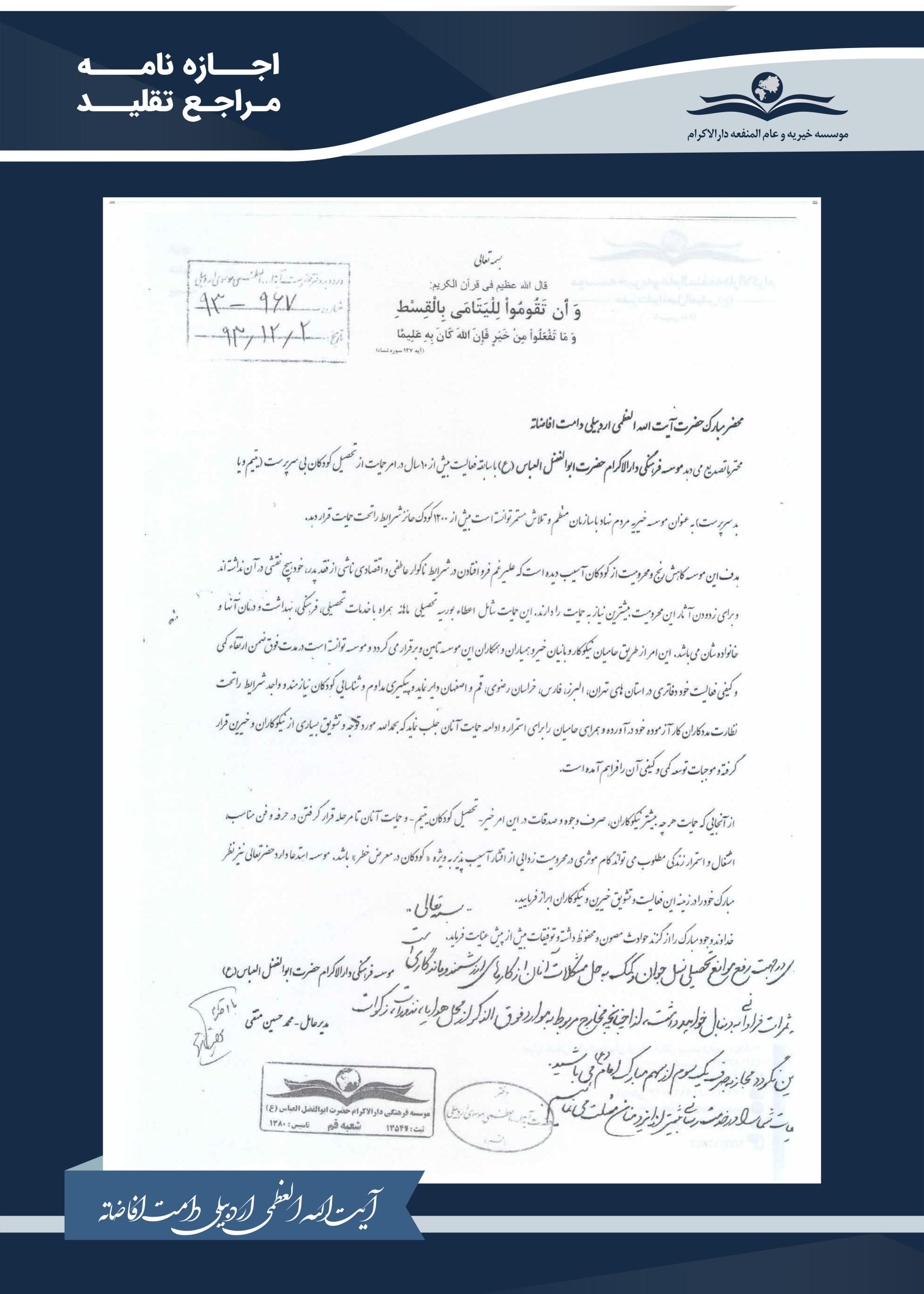

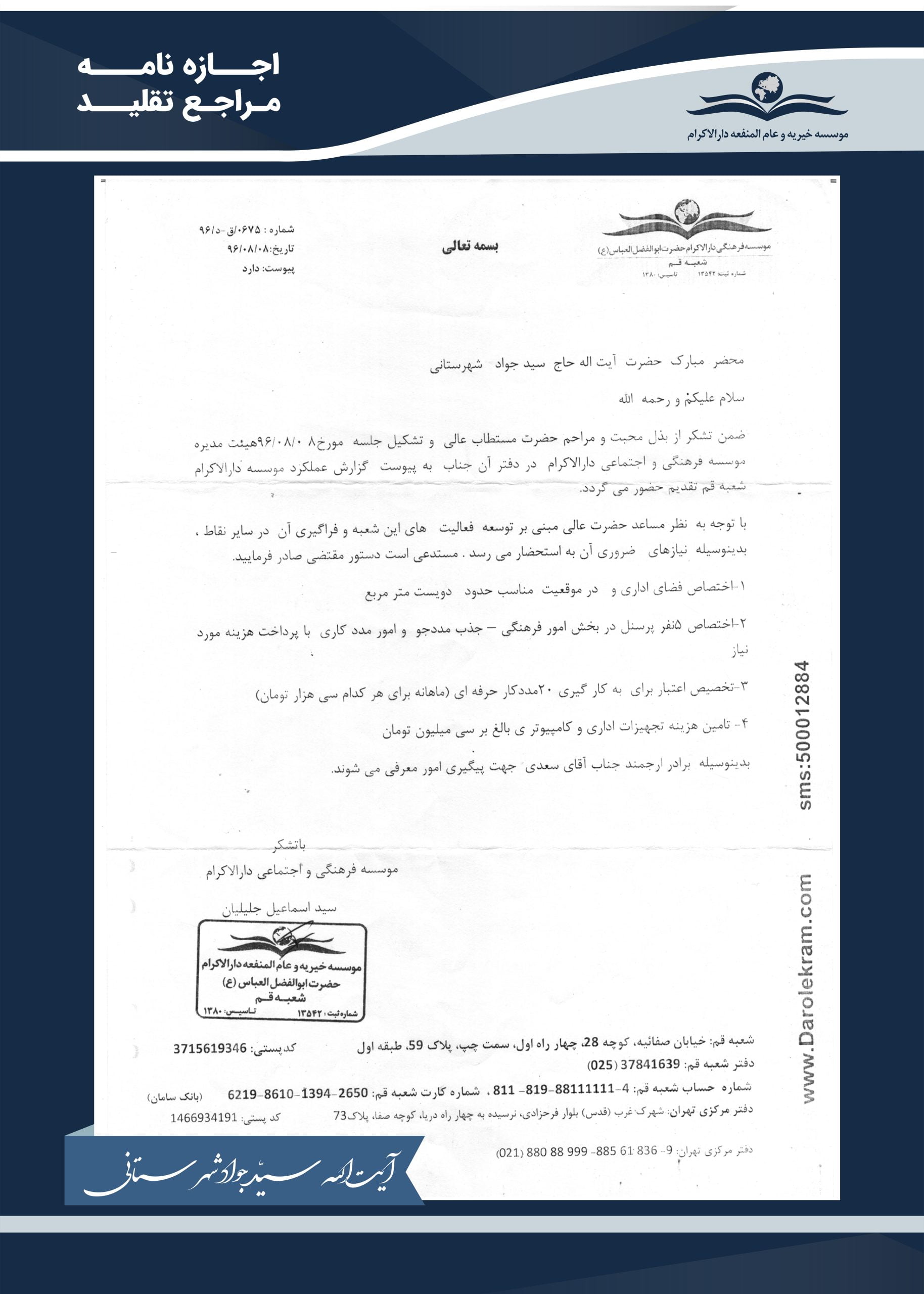

Religious Authorities Approval

With the permission letter of the major religious authorities and an emphasis on the significance of acquiring knowledge, approval has been granted to collect religious funds (Khums).

Receiving Khums Methods at Darolekram

Once the charitable deposit receipt has been presented to the office of the religious authority and permission has been granted, a portion of the amount is allocated to the institute, and the issued receipt is sent electronically to the donor, along with a description of the expenditure if the donor so requests.

About Khums Shari’i

Khums refers to the required religious obligation of any Muslim to pay one-fifth of their acquired wealth from certain sources toward specified causes.

Khums usage

Khums is a form of Islamic personal tax, and its payment and proper expenditure can solve various societal economic issues.

Khums consists of 2 parts:

A- Imam’s share: This portion of khums belongs to Imam Zaman (A.S.), and during his absence, it is placed at the disposal of taqlid authorities (who are considered Imam Zaman’s (A.S.) deputies). In addition, they use it for purposes such as maintaining religion, assisting people experiencing poverty, etc.

B- Sadat’s share: This portion of khums is given to needy Sadats to improve their life.